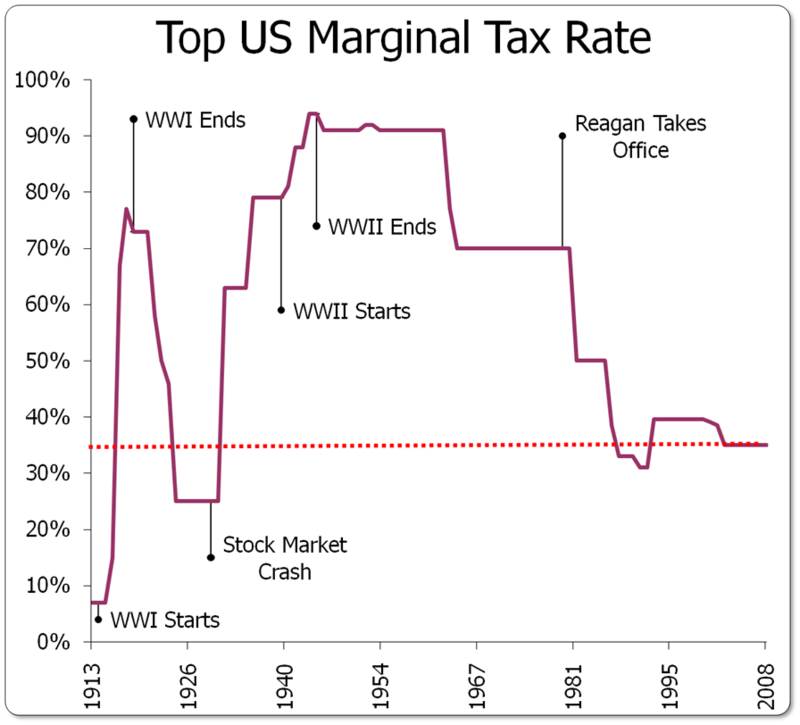

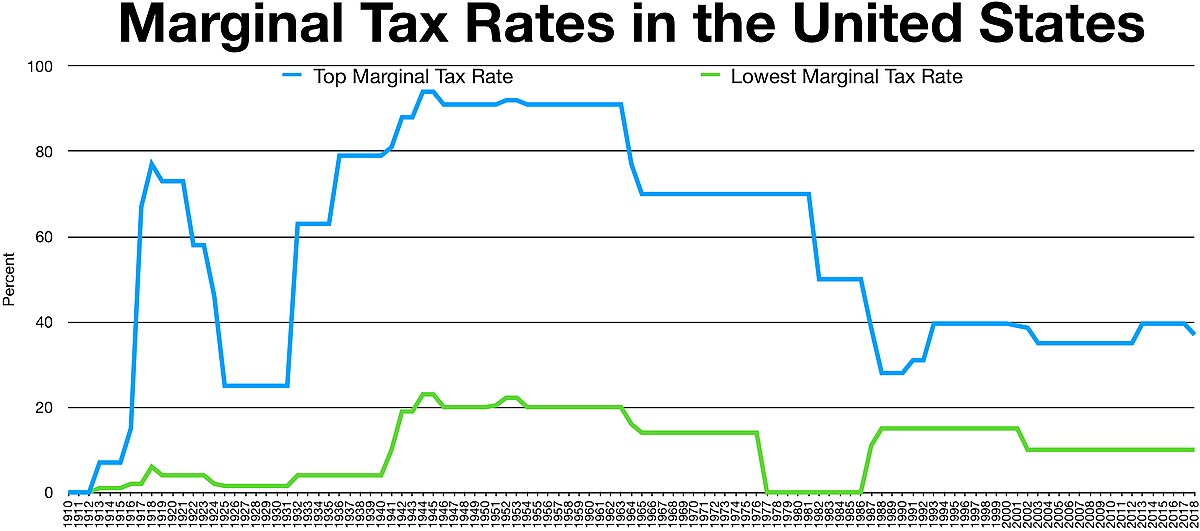

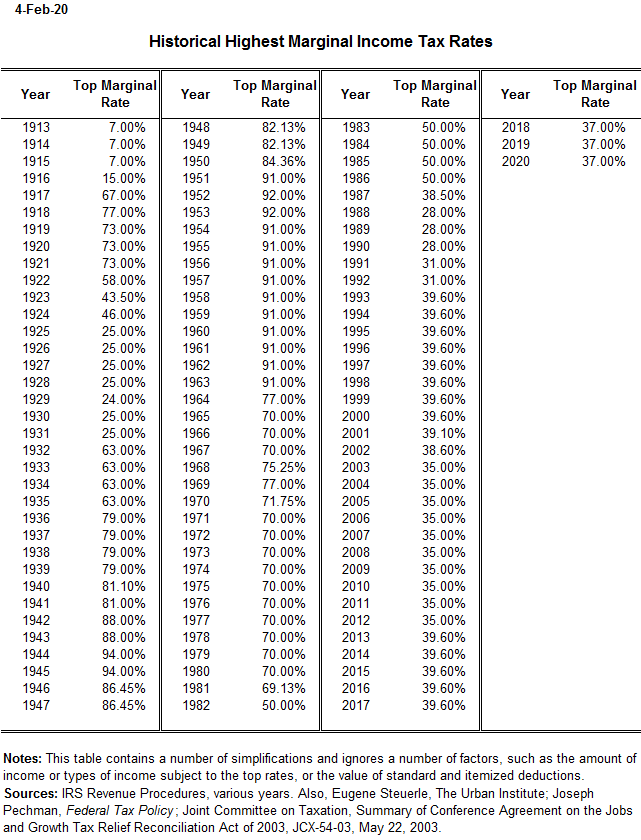

History of top marginal tax rates in the US. Source: US Joint Committee... | Download Scientific Diagram

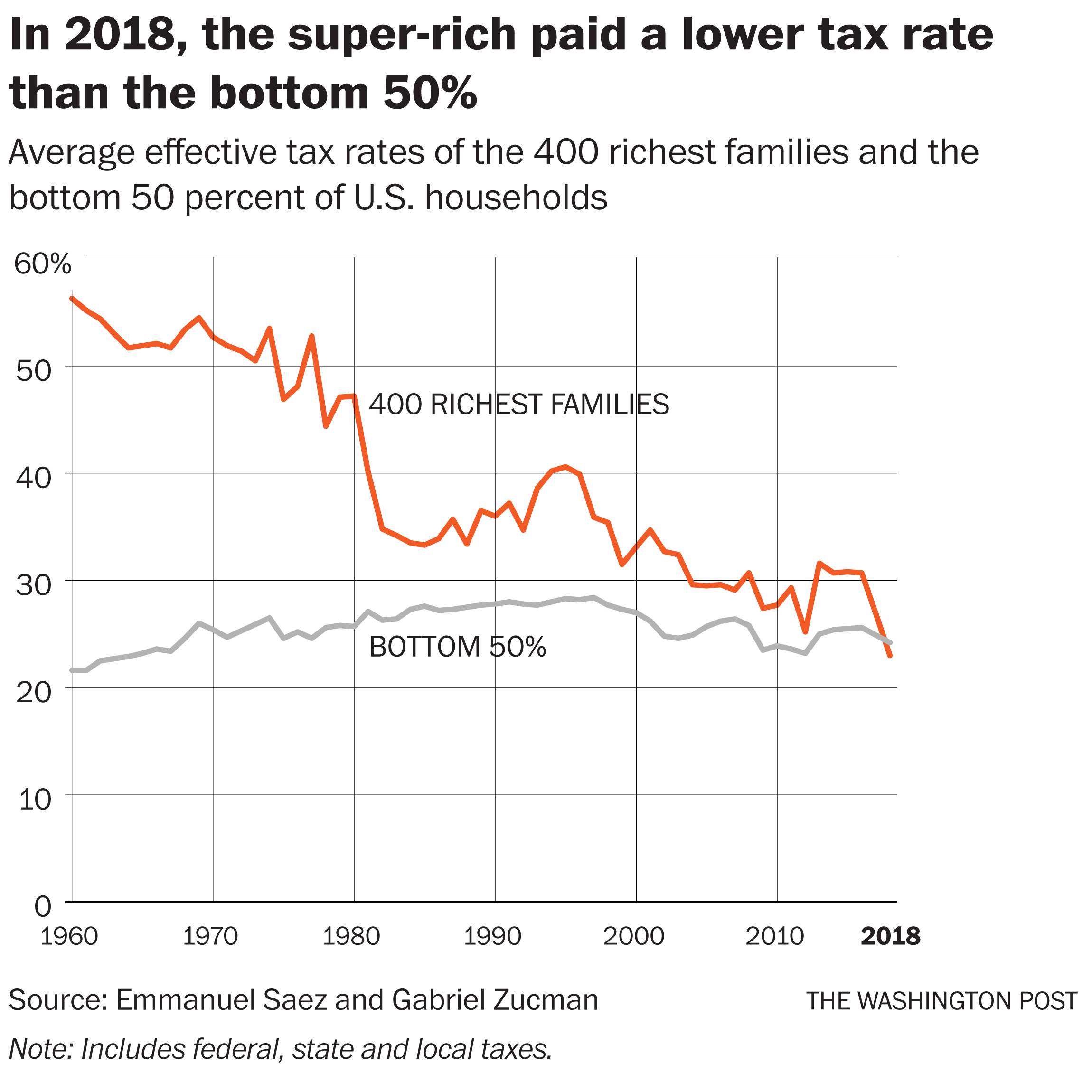

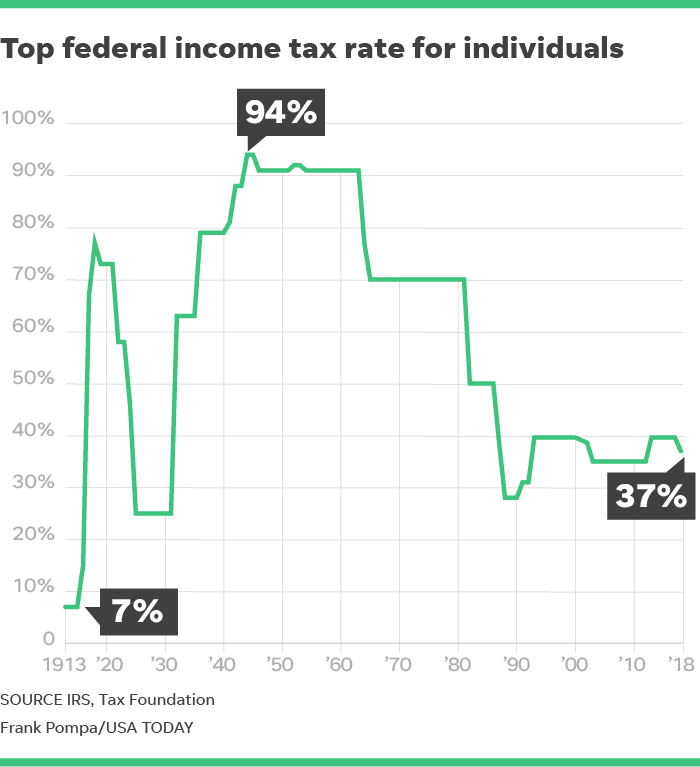

The top tax rate has been cut six times since 1980 — usually with Democrats' help - The Washington Post

People keep saying that the income tax rate under Eisenhower was around 90%. Is that really true? - Quora

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://imageio.forbes.com/specials-images/imageserve/60868250060f8ad8dd0c97eb/0x0.jpg?format=jpg&crop=1200,675,x0,y225,safe&fit=crop)

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://specials-images.forbesimg.com/imageserve/60868250060f8ad8dd0c97eb/960x0.jpg?fit=scale)